|

|

|

|

|

Cash Bids

Market Data

News

Ag Commentary

Weather

Name

Resources

|

Robinhood Is Getting Into the Social Media Game. Should You Buy HOOD Stock Here?/Robinhood%20app%20on%20phone%20by%20Andrew%20Neel%20via%20Unsplash.jpg)

Popular trading platform Robinhood Markets (HOOD) is on a roll this year, with HOOD stock riding high thanks to strong retail trading activity and a renewed boom in crypto enthusiasm. The fintech disruptor hasn’t slowed down on innovation either, and its latest move proves just that. At its HOOD Summit 2025 in Las Vegas, Robinhood unveiled a bold new step into the social media world, something that immediately caught Wall Street’s attention. The new platform, Robinhood Social, is designed to look and feel a lot like X (formerly Twitter), but with a trading twist. Investors on Robinhood Social can follow fellow traders, swap market strategies, share verified trades, and keep up with market chatter, all within the app. CEO Vlad Tenev pitched it as more than just a social tool, saying Robinhood Social could evolve into a valuable hub for investing information and community-driven insights. But that’s not all. Robinhood also announced upgrades to its Robinhood Legend desktop trading platform, which the firm launched last year. Traders will soon get access to customized financial indicators and even overnight index options, features built to keep its power users happy. So, given the company’s ambitious push into social media, is HOOD stock a buy now? About Robinhood StockSince its launch in 2013, California-based Robinhood has revolutionized finance with commission-free stock trading, making Wall Street accessible to everyday investors. Fast forward to today, the platform offers far more than just stock trades, spanning options, futures, crypto, retirement accounts, premium perks with Robinhood Gold, and even managed portfolios through Robinhood Strategies. Robinhood, the commission-free trading pioneer that went public in 2021, now carries a market capitalization of about $102 billion. After a rocky public debut, the company is now in the midst of one of its strongest years yet, lifted by new product rollouts as well as a rebound in crypto trading, thanks to a more friendly regulatory backdrop. In a sector known for heavy regulation and slow change, CEO Vlad Tenev has guided Robinhood’s evolution from a startup disruptor into a major financial player. And the latest innovations unveiled at HOOD Summit 2025 underscore just how rapidly the platform continues to broaden its reach. Moreover, after months of speculation and waiting, HOOD stock investors have even more reasons to be happy now, as the company is finally preparing to join the prestigious S&P 500 Index ($SPX) on Sept. 22. The inclusion is expected to trigger billions in trading activity, with index funds and exchange-traded funds (ETFs) scooping up shares to mirror the benchmark, potentially unleashing a strong wave of passive inflows. HOOD stock has been on a tear. Over the past 52 weeks, shares have skyrocketed a stunning 430%, leaving the S&P 500’s 18% gain in the dust. The rally hasn’t slowed in 2025, either. Year-to-date (YTD), HOOD stock is up 208%, compared with just a 12% return for the broader index. The company keeps touching fresh highs, with Robinhood’s stock hitting a new all-time peak of $123.44 on Sept. 10. HOOD is only down about 7% from this level.

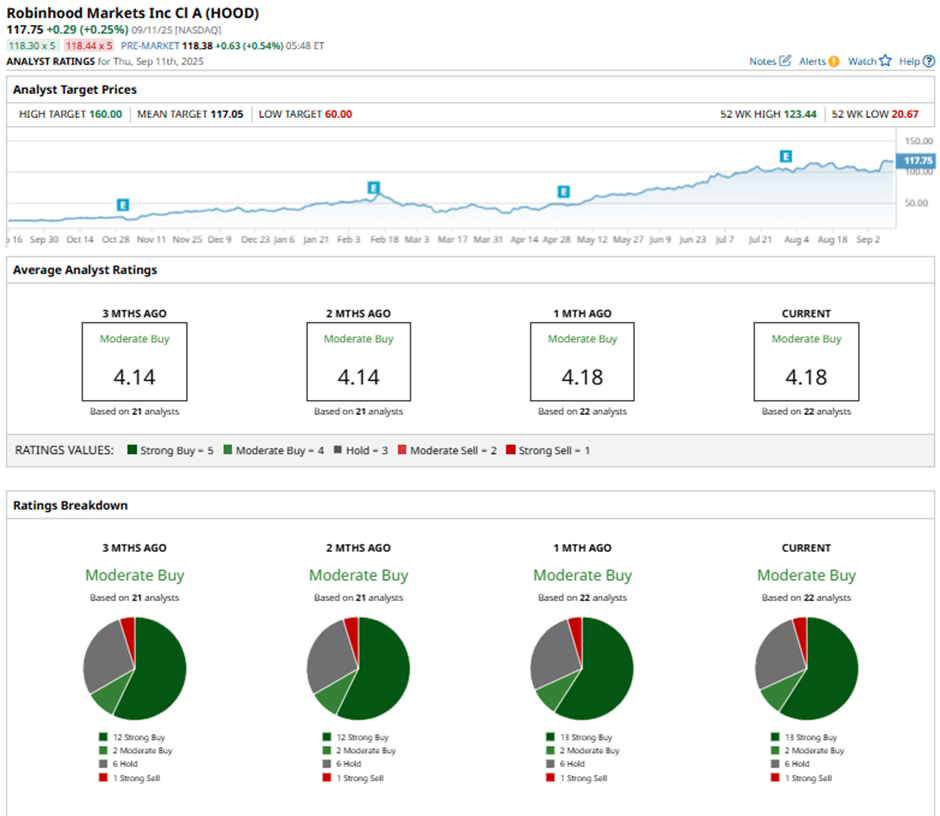

Robinhood’s Q2 Earnings SnapshotRobinhood’s fiscal 2025 second-quarter results, released on July 30, came in well above Wall Street expectations. Revenue jumped 45% year-over-year (YOY) to $989 million, comfortably surpassing the $920.4 million forecast. The strong performance was driven by a 65% surge in transaction-based revenue, a key indicator of trading activity, with robust contributions from cryptocurrencies, options, and equities, all signaling healthy engagement across the platform. Cryptocurrency trading led the charge, with revenue nearly doubling to $160 million, a 98% jump from last year, as digital asset activity came roaring back. Options trading followed closely, generating $265 million, up 46%, reflecting growing demand for higher-margin derivatives. Equities also saw strong gains, climbing 65% to $66 million. Robinhood’s strength went well beyond trading, however. Other revenue jumped 33% to $93 million, driven largely by the rapid growth of Robinhood Gold. The premium subscription, offering higher cash sweep rates, larger instant deposits, and advanced research tools, saw memberships surge 76% from the year-ago quarter to 3.5 million. Profits impressed just as much, with EPS doubling to $0.42, beating expectations by a hefty 36% margin. On the platform front, Robinhood saw funded accounts rise 10% YOY to 26.5 million, while total assets under custody nearly doubled, surging 99% to $279 billion. This impressive growth was driven by strong net deposits, strategic asset acquisitions, and rising valuations across both equities and cryptocurrencies. The quarter ended with a robust $4.2 billion in cash and cash equivalents, highlighting the company’s strong financial foundation and operational stability. Meanwhile, analysts tracking Robinhood project the company's bottom line to soar a notable 46% YOY to $1.59 per share in fiscal 2025, followed by another 18% rise to $1.88 per share in fiscal 2026. What Do Analysts Think About Robinhood Stock?Following HOOD Summit 2025, Wall Street analysts are showing strong confidence in Robinhood and its lineup of new features. For instance, Barclays analyst Benjamin Budish highlighted the company’s new social media platform and its accelerating rollout of updates, calling them modern and user-friendly, while maintaining an “Overweight” rating with a $120 price target. Piper Sandler analyst Patrick Moley pointed to the significance of short selling and social trading capabilities, with particular excitement around the upcoming Robinhood Social platform, set to launch in early 2026. Moley believes this new social platform could unlock significant potential, especially among younger, community-driven investors. KeyBanc’s Alex Markgraff also weighed in, raising his price target to $135 from $120 while maintaining an “Overweight” rating. The analyst views the platform’s expansion as a catalyst for higher trading volumes and deeper user engagement, reinforcing Robinhood’s growth story as it continues to innovate. Overall, Wall Street remains upbeat on HOOD, with a consensus rating of “Moderate Buy.” Among 22 analysts covering the stock, 13 call it a “Strong Buy,” two lean toward a “Moderate Buy,” six recommend “Hold,” and just one issues a “Strong Sell' rating. Even though HOOD stock’s meteoric rise has pushed shares near the average analyst price target of $118.37, optimism remains strong. The most bullish Wall Street forecast of $160 suggests about 39% potential upside, which could propel the stock to yet another record high.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|